Are you one of those people who see mind-blowing deals, on AliExpress, Banggood, Geekbuying, Amazon and Gearbest, then end up ordering nothing from them, because you don’t have a credit card or an internet working debit card? Is lack of a credit card limiting your shopping options? Do you miss amazing prices and deals on international websites, just because you can’t afford an international prepaid debit VISA or MasterCard to place an order?

Well, today we’re going to solve your problem once and for all, by telling you about the top internet prepaid debit cards in Pakistan. You can use these debit cards on any international website.

Faysal DigiBank

Backed by MasterCard, Faysal Digibank Virtual Card is promising its account holders something new. The virtual card! There are two types of Virtual Cards: One-Time Disposable and Reloadable. They can be used anywhere in the local and international online stores where MasterCard is accepted.

How can I get a Digibank Virtual Debit Card?

If you hold an account with Faysal Bank, you can login to their internet banking or Mobile App and select a card with your preferred limit. Follow these steps:

1. Login to your Faysal Digibank Account via web or App

2. Click on the Virtual Card to choose your desired limit

3. Generate and validate the OTP to create Virtual Debit Card

4. Receive the 16 digit card number with an expiry date, and 3 digit code details in your account

What are the subscription and annual charges? How to pay the charges and activate?

There are NO activation charges for the cards and reloads are free too. There is however an up to 4% charge on cross foreign transactions.

How & where can you use your Faysal Digibank Virtual Debit Cards?

Just type out the 16 digit card number along with other specs and you’re done! You can pay for subscriptions, educational certificates and licenses, advertising fee, purchasing apps, games, eBooks, movies and much more.

Pros

- Card usable everywhere MasterCard is accepted

- Reloadable card allows 10 transactions up to 200,000

- Chances of theft lessen as the One-Time disposable card expires after first use and reloadable expires after 6 months

- Free Reloads

- Can use these Debit cards internationally and locally

- Multiple reloads via App

- Virtual presence diminish the chance of card theft

Cons

- No ATM withdrawals

- No point of sale swiping in stores or retailer outlets

- Expiry of 6 month translates to some hassle where you need to make annual charges

- Monthly subscriptions can take place up to 6 months only, due to the 6 months expiry date

MCB Lite

Just as its name, MCB Lite is light on your pocket. It’s a debit card from MCB Bank Limited. It is a bank account which is a combination of an app and a prepaid VISA debit card. With MCB Lite, your mobile number becomes your Lite account number so you don’t need to panic about remembering your account number. The MCB Lite VISA prepaid debit card can be used to shop at any international website. To perform and keep a track of your transactions, MCB Lite has a web based interface, and an app for both android and iOS.

How can I get an MCB Lite Debit Card?

MCB Bank offers a variety of options to apply for the Lite card. Keeping in view your ease, you can obtain the VISA debit card by any of the following methods

- Apply online and get the MCB Lite card delivered to your doorstep (isn’t that amazing?) in 7-14 working

- Call MCB Helpline 021-111-000-622

- SMS lite to 6222, or

- Visit any Lite Enable Branch

What are the subscription and annual charges? How to pay the charges and activate?

The joining and the annual fee of MCB Lite is PKR 300 only. Once you receive the Lite card, there will be no balance in your Lite account, but don’t you worry, you can deposit the initial balance by any of the following methods:

- Easypaisa or Jazzcash account / shop. Use the option “send money to any bank,” then select MCB Bank, then choose Easypaisa or Jazzcash (charges may apply).

- Nearest MCB Branch (Free)

- IBFT from any other bank (other bank charges may apply)

- Transfer from any other MCB account via ATM or mobile Banking (FREE)

Once you have deposited a minimum of PKR 300 in your Lite account, you can call MCB helpline (021-111-000-622) to activate your Lite card and you are done.

How can you use your Lite card for online shopping?

By default, the MCB Lite Card is disabled for online shopping at international websites but you can call MCB helpline (021-111-000-622) to activate your Lite card for online shopping. As per your request, the MCB Lite card will be activated for international shopping, for a limited time period or a lifetime.

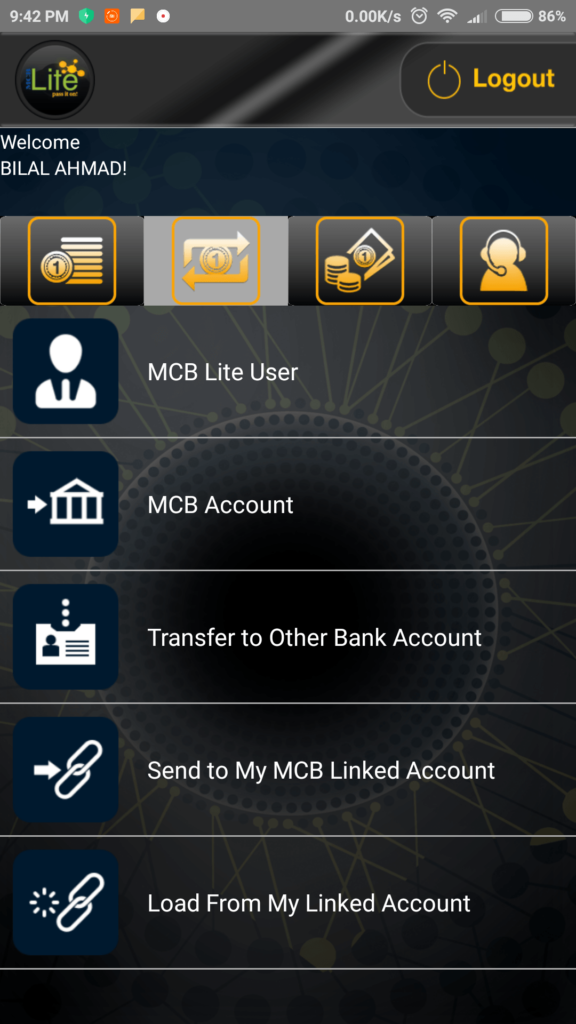

What you can do with the MCB Lite app?

The MCB Lite app works as a mini version of internet banking for your Lite account. You login with your account number (Mobile number) and a login PIN. You can do the following with the app:

- Check your balance and mini statement of the last 10 transactions (Free)

- Send money to any MCB account or MCB Lite account (Free)

- Send money to any other bank account via IBFT (For PKR 30 up to PKR 100,000)

- Buy top-ups, pay mobile bills, pay utility bills and donate money (Free)

- Contact MCB Bank via E-Mail (Free)

Here is how the MCB Lite app interface looks

Transaction Limits of MCB Lite

You can find the transaction limits of MCB Lite here

Pros of MCB Lite Card

- You can perform and keep a track of all the transactions via app or web based login

- Free SMS alerts on every transaction

- Variety of options for depositing funds

- Your phone number is your Lite account number

Cons of MCB Lite Card

- It is very difficult to access helpline services sometimes. The calls you make to the helpline are frequently disconnected especially during peak hours.

UBL Wiz Card (suspended)

Just like MCB Lite, the UBL Wiz Card is a product of UBL bank backed by MasterCard that lets you shop at international websites without the hassle of opening a bank account. Compared to MCB Lite, it has less features, but still remains a good option for online shopping.

How can I get a UBL Wiz Debit Card?

Unfortunately, there is no online application for applying for this card. Hence, you will have to go to the nearest UBL online branch, along with a photocopy of your CNIC, a proof of your job or business, and an initial deposit of PKR 500.

What are the subscription and annual charges? How to pay the charges and activate?

The initial subscription charges of the UBL Wiz card are PKR 110, which can be paid at the time of subscription at the branch. You will fill one form for subscription and then deposit money in your UBL wiz card. The amount can be deposited at UBL branches only. After you have deposited the amount, you can activate your card by calling UBL helpline (021- 111 825 888). The first eight digits of your Wiz card is your account number.

How can you use your UBL Wiz card for online shopping?

By default the UBL Wiz Card is disabled for online shopping at international websites. You can call the UBL helpline (021- 111 825 888) to activate your card for online shopping. As per your request, the card can be activated for international shopping for a limited time period or for life.

Features of UBL Wiz Card

- Any person having a valid CNIC can obtain a UBL Wiz card

- Can be used at all ATMs and point of sales (VISA and MasterCard acceptability only) across the globe

- Mini statement, balance inquiry, and utility bill payment via UBL ATM only

- Free e-statement facility

UBL Wiz Card Limits

You can find the UBL Wiz card transaction limits here.

Pros of UBL Wiz Card

- Good customer support via helpline

Cons of UBL Wiz card

- No SMS alerts, so you don’t know the exact amount you pay per transaction

- You can reload your card at UBL branch only.

- You have to visit UBL ATM for checking balance, mini-statement or performing a transaction like paying utility bills.

- No dedicated app on either platform. Functionality failures on main UBL iOS app.

You may have heard that Pakistani banks put hidden charges or taxes when you use a card at an international website. Well this is a misconception. We maintain our bank accounts in PKR whereas payments on international websites are in US dollars. At the time of payment, your bank converts your PKR to US Dollars and it charges a fee for converting your PKR to USD. This fee is called conversion fee which is 3% for payments made via MCB Lite and 4% for payments made via UBL Wiz card. For example if inter-bank rate of USD is PKR 100 on a particular day, you will end up paying PKR 103 if you pay with MCB Lite and PKR 104 if you pay with UBL Wiz.

Which Debit Card is Better?

Well, as an online shopper myself, I know the pains of not being able to make a purchase because of banking or debit card restrictions. In my opinion, Faysal Digibank Virtual Card is way better than the other two options. UBL Wiz is limited to a card, UBL branch and an ATM. While MCB Lite offers features such as: the prompt SMS alerts, variety of options for depositing funds, and performing and monitoring transactions via their app. However, MCB keeps removing the card facility for new users which makes us verify, double check and wonder what is MCB up to.

For now, with Digibank Virtual Cards, powered by MasterCard, it seems obvious that they are the winner.

I tried bank alfalah Islamic visa debit card for online shopping on Amazon but payment declined though I have activated for online shopping.

Question,,,,

Is this card eligible or can be used for amazone?

Which card is best for buying pubg uc or purchases

The online application for MCB Lite doesn’t work. It asks for OTP and referral code. Neither of which a new user can have. Kindly let me know the solution, thanks!

Contact the Bank with your query

Why Ubl Wiz card temporary suspended

It was nice reading your post. Very informative indeed. If you have time, please visit our posts on.

JS internet banking

hey there how can I get a debit card without having a bank account and i need because I m a digital marketer and also I don’t have a bank account ether

Try Easy Paisa Card

Is mcb lite card is best for international national shopping in 20202.

national or international? Please proof your comments before submitting.

Hello

Can i use mcb lite with netflix and in abroad like in us for paying for dinner

Netflix yes, abroad don’t know.

What about jazz cash debt card for international online shopping?

Can I buy a web domain with this card ?

You can use this card everywhere where VISA cards are accepted.

I have an Hbl debit card, I want to do some online international payments in dollors. How can I enable my card for these payments?

call their helpline…

please give me solution i want to create aws (amazon web services )accout. which card is best for me .MCB lite or ubl wiz card.?

If these services require recurring payments then i would suggest you to get a credit card. If its a one time payment then you can get mcb lite or ubl wiz.

my Mcb Lite is not working on AliExpress any more can you suggest a card which Ali Express accept

Bilal attaintion!! I want to order my MCB lite card so plzz confirm me this man lite debit card can be useable of facebook ads and google AdWords?? Plzz confirm me AsAP because I have allied assan A/c the the assan A/c debit card doesn’t allow me facebook and google to run ads on this card and as well as jazzcash the same situation… Plzz confirm me then I am ready to diliver my MCB lite debit card

If these services require recurring payments then i would suggest you to get a credit card. If its a one time payment then you can get mcb lite or ubl wiz.

Heard of MCB Lite Card problems on Aliexpress. What’s the reality?

My MCB lite card is working fine. I have not faced any such difficulty.

Plz tell me that bank alfalah and askari banks have internet cards for online shopping just like MCB Lite, ABL EZCash, UBL WIZ Card

No.

Mcb lite card is no more working on alixpress . I tried so many times and contacted help line in last they said alixpress banned mcblite card . Which I was very frustrated . Why in Pakistan we don’t have proper and verified international payment system. Litecard fails . Now please help me guys what to do. Which bank card is athentic and verified globally. Thanks

brother you have to open meezan asan account with 0 fee im using it and their mater is very good and friendly in use im also buying products from amazon with asan card

Does they have any annual fee?

Can I shop from Aliexpress and EBay using mcb lite card? Someone told me mcb is banned from aliexpress …And can a student apply for mcb lite card?

Yes you can shop from aliexpress and amazon.

Yes a student can get an MCB lite card.

Which Debit card do not charge 3 or 4 % transaction charges when we use them to buy something from Amazon or Ebay in USD ???

In my experience, most of the cards charge this amount. So far i have used MCB and Bank Alfalah cards. Both of them charge.

i have been trying to use bank alfalah visa debit card for netflix account but its not working give me any suggesition

Some cards have stopped supporting Netflix payments because they feel the movies on Netflix are not appropriate… Please try another card, or purchase a Netflix card to load the balance directly.

@Huzaifa what alfalah debit card are you using for online payments? I have an alfalah Islamic visa debit card but the bank says it cannot be used for online payments?

Use your existing VISA or master card issued by your bank. First you need to activate it by calling the helpline. If you don’t have a bank account then get an MCB lite card.

Which card is best for subscription of icloud,one drive….and payment of ebay etc.

If you have a debit card from your bank, it will work.

Bhai I want to make unlimited purchases from amazon or eBay so which Visa card or master card I should Make which allows unlimited shopping internationally please reply.

Use your existing VISA or master card issued by your bank. First you need to activate it by calling the helpline. If you don’t have a bank account then get an MCB lite card.

how to receive amount in Lite card from other friend

farooq

Your mobile number becomes your MCB lite account number. Tell your friend your mobile number and he can send by choosing the option “send to MCB lite” from his MCB lite app.

Thanks Bilal

Can i use jazzcash debit card or mcb lite card for boosting my ad compaign on Facebook because Facebook accepting Pakistani currency then can i use jazzcash debit card or mcb lite card on Facebook to run ad compaign

Yes you can use MCB lite card. Jazz Cash debit card does’t support online payments.

How can i pay for an online cource on Udemmy?

You can pay using a visa or a MasterCard. MCB lite is a VISA card.

Assalamualikum’ guys I’m a forex trader in Pakistan and I do international transactions through ewallets but I want to do transactions through credit or debit card so which bank allows international transactions for forex trader can you suggest any bank card?

I m freelancer and receive payments in skrill account and i want to link my skrill account to mcb lite(yet to own).Does it works?

Long time back I connected my SCB account with Skrill and I would then withdraw the money in it once a month. I don’t think Skrill allows withdrawing in cards. Yes you can load the Skrill account with your card…

I also want to ask u… I am trader which is the best method or what i do for deposit and withdrawal….

Plzzzzz tell me fastly…..complete detail plzzzzz

Don’t know. Ask someone who trades like you. This is not a Q/A forum.

New Update:

MCB Lite no more supports MOTO Transactions like subscription etc so you won’t be able use it on to buy icloud storage or google one or any google subscriptions.

WT! you mean it won’t work if I want to have a Google Developer Console account?

Hello, I have account in Bank Alfalah but it don’t supports online purchasing, like payment for facebook Ad campaigns, Amazon Prime, Netflix etc. Which bank do you suggest is better for online purchasing via Debit Card? My main concern is to run Facebook Ad campaigns through Debit Card, as I don’t want to use credit card.

With Alfalah there is a a time limit on online transactions. My SCB and Meezan Debit cards have no such issue.

Meezan debit Visa cards are best for international payments

I have used it with Aliexpress, FB Ads, Adwords etc

do they have any transaction charges on them while paying for the payments you mentioned

With some, yes.

Hello, can the MCB Lite card be used to pay for online courses on Coursera and EdX?

Definitely!

Dear Bilal Bhai,

I am using wiz internet card since 8 years. This card donot require any session activation as it is by default activated for internet. But since last year i am facing difficulties as no online merchant is accepting wiz card and they say that your card is 3d secure.

And it will work only on those sites which have 3d secure functions so i think wiz card is no more considered as online shopping card.

Do you have any idea about this/

Please contact with your bank. Most of the times they issue you a new card with no extra charges. the new card is more secure and compatible with latest payment mechanism on websites.

Hi,

I need to make a payment of around PKR 1 million. The payment is tuition fees of an international university but it is to be paid in Pakistani Rupees to a third party. It allows to pay via Visa Card. Will I be able to make this payment from my Debit Card? or will there be a transaction limit issue? Can I resolve this transaction limit issue by consultation with the bank?

I hope you have resolved the issue by now but just for information, if you have enough money in your account, please go ahead with your debit card.

Hi, how can I pay for Netflix as I have already tried my ABL debit card cannot work for this purpose and ubl wiz card is inactive so what could be simple option?

ABL has some issues with online payment even for buying airplane tickets. Best solution for Netflix is to purchase a prepaid card available on Keenu, Shophive, techstudio.pk

Mr. Bilal Ahmad

Can you please tell about which international Online Websites are compatible with MCB LITE card.

My main query is for

– UBISOFT

– Amazon

– ebay

– Alex press

Regards,

All the websites that accept VISA cards.

plz send me application form link

https://www.mcblite.com/mcb_aims_v1/faces/Referral.xhtml

My MCB lite card not working on internet I already activate on help line please help me

Please call the helpline.

Can we use MCB lite / wizz card for shopping on aliexpress.com as state bank ristricted foreign transactions on all debit cards now a days.

Yes you may, but I do know that MCB lite has gone inactive, but my MeezanBank debit card works well with all international purchases. Also with Daraz’s partnership with AliExpress, you may just get the product via Daraz, no?

Ali express has a huge variety of products than daraz and secondly, there are some products that are way cheaper on aliexpress than daraz (incl shipment). Hence the only drawback is long shipment time on aliexpess.

Hi sir. Godaddy se cheap domain buy karne aur Google aur Facebook par campaign chalane k liay konsa card acha hoga.

Whichever your bank issues.

Can I use these cards as payment method for recurring subscriptions like Netflix and Patreon?

You could even use any PK card…

Yes. For recurring payments, you will have to activate your MCB lite or ubl Wiz card for online payments permanently or for the period in which you want the recurring payments to be made. Ensure there is sufficient money in your card as these are debit cards.

Bhai online MCB ka account ni bn raha, kia kro?

Online account nhe banta. aap branch jaen.

Salam brother, i have applied for MCB Lite Card since two months the card has not been arrived, and also i want to know i want to advertise my website in Facebook ads, google adwords and twitter promote ads, would MCB Lite Card works for advertisings?

You can get the latest information of your MCB lite card status by calling MCB helpline 021-111-000-622. Yes it will work for advertising.

I applied for MCB Lite about a month back. Still they say that due to maintenance new cards are not being issued. They should have told that while I was applying. Really disappointed

Well i have applied on 10th Aug 2018 and today it’s 28th OCT ALMOST MORE THAN 2 MONTHS still i have not received it. they said ill get the card in NOV lol…

You guys need to contact the helpline of MCB bank limited. sometimes it is delivered to your nearest MCB branch.

What is per day debit limit on MCB lite

i.e. wiz card has Rs. 100,000 debit limit per day

You can view the charges and limits here

https://www.mcb.com.pk/personal/charges-and-limits

Any other option because new mcb lite card not available since 2 months ago

Call MCB helpline to know the status of your MCB Lite card. You can also visit UBL branch for getting a ubl wiz card.

head office closes the lite cards dont know when they will open but i think they have to open ASAP because they are loosing clients

MCB lite cards are working fine. I am a member of many groups for online shopping and no user has reported anything. My own MCB lite card is working ok Please contact mcb helpline if there is any issue in your MCB lite card.

Sir,

Online merchant Kalya koi tareeka btayen, mean k withdraw aur submit Dono hojae.

Which online merchant ? can you please be more specific ?

In how many days can i receive my MCB lite card

Usually you will get your card in 10-20 days from the date of application

@Bilal Ahmad When I’ll have to pay annual charges?

At the time you get the card, you will have to deposit Rs 400 in your lite account from mcb branch or IBFT from any other bank. MCB bank will automatically deduct Rs 375 for the first year and then after one year the amount for 2nd year will be deducted from your lite account.

UBL Wiz Internet Card and MCB Lite ke annual charges kitny hain?

You can get an updated view of the charges by following these links

https://www.mcb.com.pk/personal/charges-and-limits

http://www.ubldirect.com/corporate/BankingServices/CardProducts/UBLWiz/FeeStructure.aspx

You can use this card to make online payment anywhere. I am not sure what do you mean by associating your card ?

Assalamualaikum bilal bhai can you please tell me that i can associate this MCB lite card in my website transactions or my google adsense account?

Sir i am calling mcb help line for 1 week they always have system error while activating my internet session. Did you faced the same problem??

Perhaps try calling during working hours? Hopefully now that holidays are over, they have managed to fix the problem. If I was in your place I would call on a Tuesday to give them a full day to fix whatever issue it is they are having.

MCB lite card is not still working with aliexpress.com so i think its not suitable for online shopping MCB lite card have totally failed and purchasing card fee is RS:375 not 300

please correct it

as well as i have no experience of UBL wizz card i will try it and update you guys soon

Please activate your card for online shopping by calling MCB helpline and ensure it has enough balance (interbank rate + 3% +3% (bank conversion fee+tax) ) I by stuff worth 30,000 every month from AliExpress using my MCB lite card. It is one of the best cards for online shopping. As far as the annual fee is concerned, the bank changes it in every July and January. We published this article in May and the fee changed in July. if you have any further questions please feel free to ask.

Hello, While applying for MCB Lite online, it is asking for Invitation Reference and OPT we can leave the Reference field blank but what about OPT. If I leave that field too it gives me this error; “Please enter OTP. All fields with ‘*’ are mandatory”.

What should I do now?

Leave the invitation reference blank then you won’t get this error.

What is the annual charges of different mcb lite 0, 1, 2?

I can’t find.

Annual charges are PKR 375 (incl of all taxes)

https://www.mcb.com.pk/personal/charges-and-limits

What is invitation reference and otp?

You can leave these fields blank.

But when leave OTP, it gives me error: “Please enter OTP. All fields with ‘*’ are mandatory”. What should I do?

It’s a bug in their website. Try to go to their Main Branch and make request there. For now they are updating their card chips so they can’t deliver it to you within 7 days, that bank officer says me it will take 1 month to get my card i applied on 10th of Aug 2018.

This is a referral link, sign up from their official website https://www.mcb.com.pk/become_a_customer/home